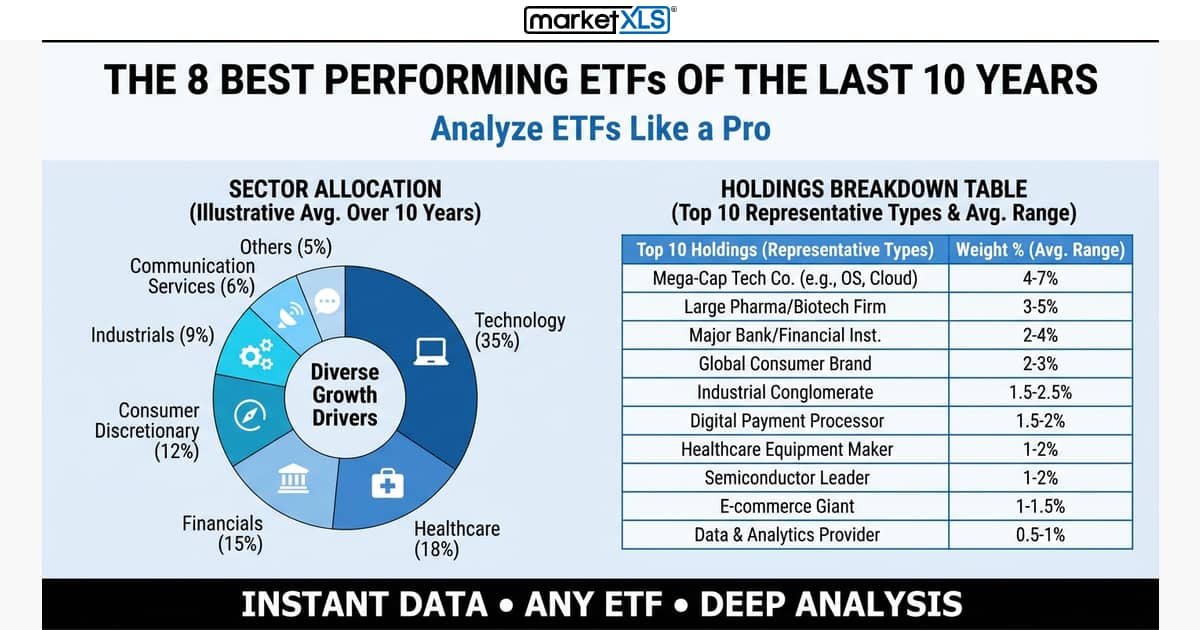

Discover the 8 ETFs that delivered the best returns over the last decade (2015-2025). Technology and semiconductors dominated with SOXX leading at 26% annual returns.

MarketXLS Blog

Expert insights on stock market analysis, investment strategies, and Excel techniques for smarter investing.

Featured Series

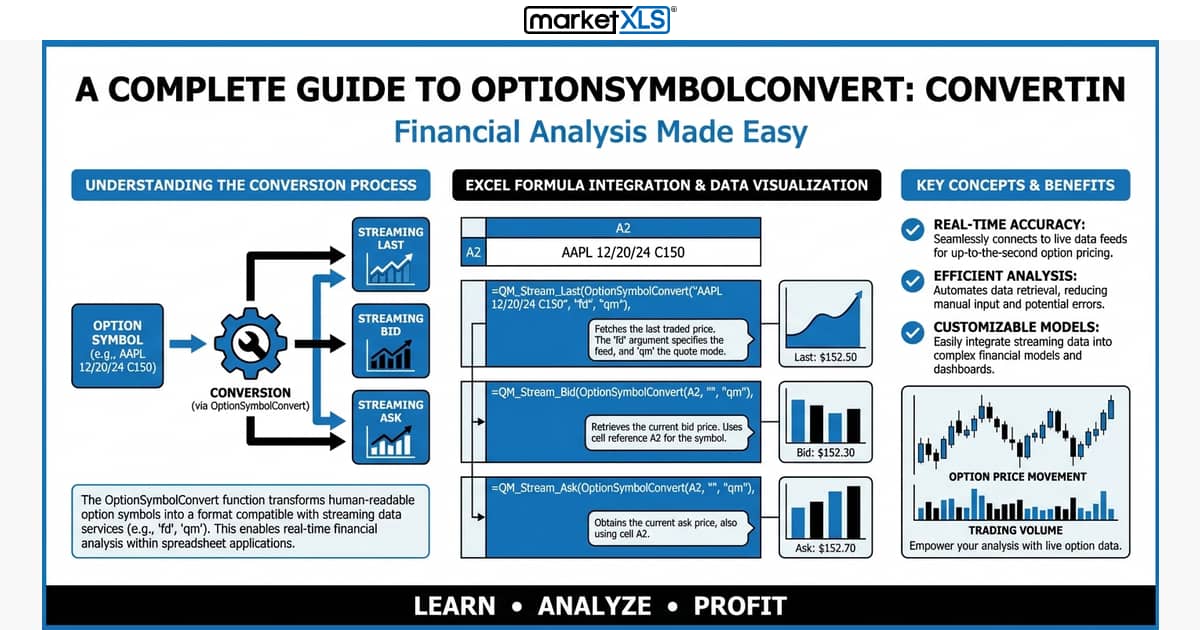

Learn how to seamlessly convert option symbols between different broker formats using MarketXLS OptionSymbolConvert function. Support for Fidelity, Charles Schwab, Yahoo Finance, and more.

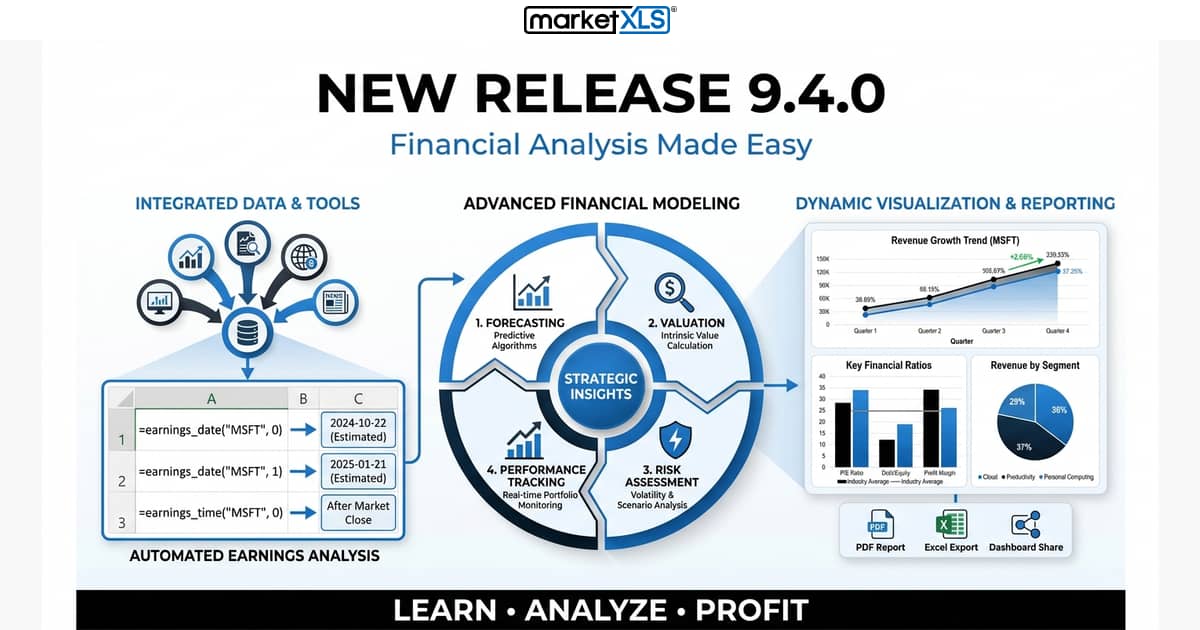

Release Date: August 12th, 2025We are excited to announce the release of MarketXLS version 9.4.0. This update brings significant improvements to symbol compatibility, performance enhancements, and...

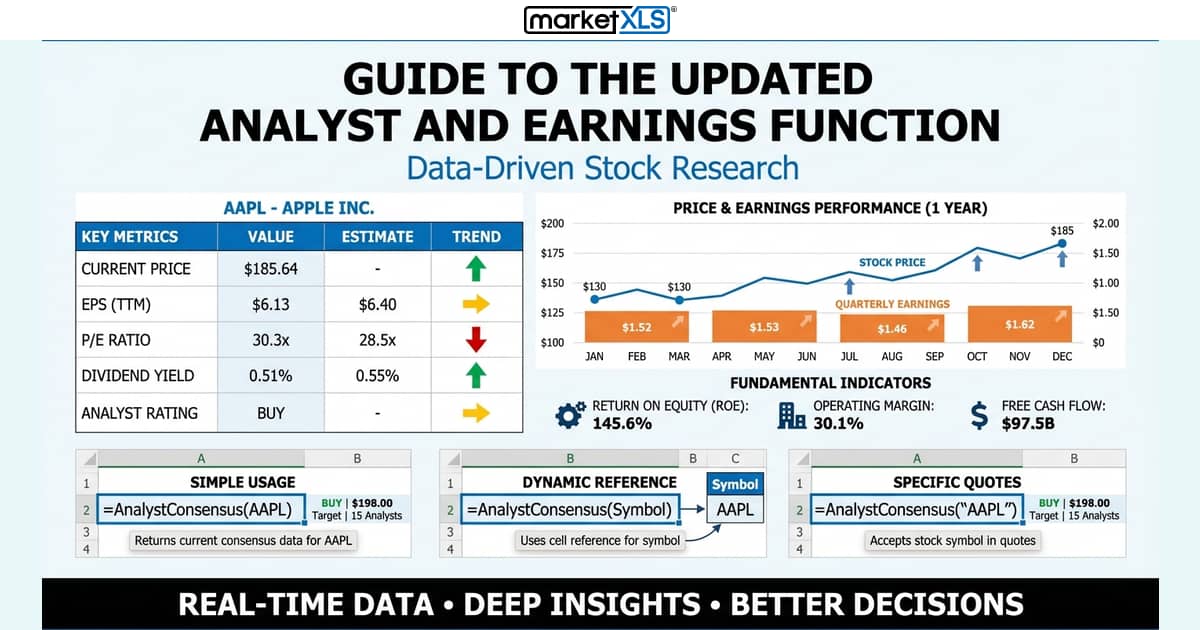

MarketXLS has added a new set of functions for analyst and earnings data. This guide provides an overview of each function and its usage. Analyst Coverage Functions These functions provide data on the number of analysts covering a stock. Example: =AnalystConsensus(AAPL) returns the number of analysts whose estimates are included in the consensus figures for */ -->

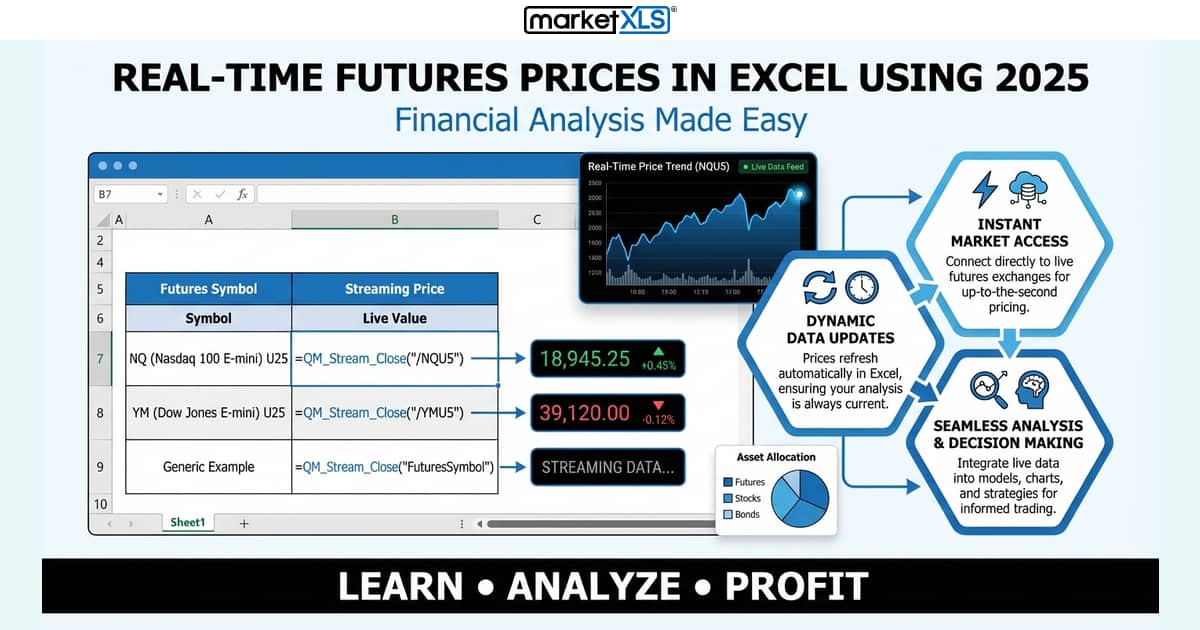

Get live streaming futures prices in Excel with MarketXLS. Track Nasdaq, Dow Jones, S&P 500, Crude Oil, Gold and more with real-time QM_Stream functions.

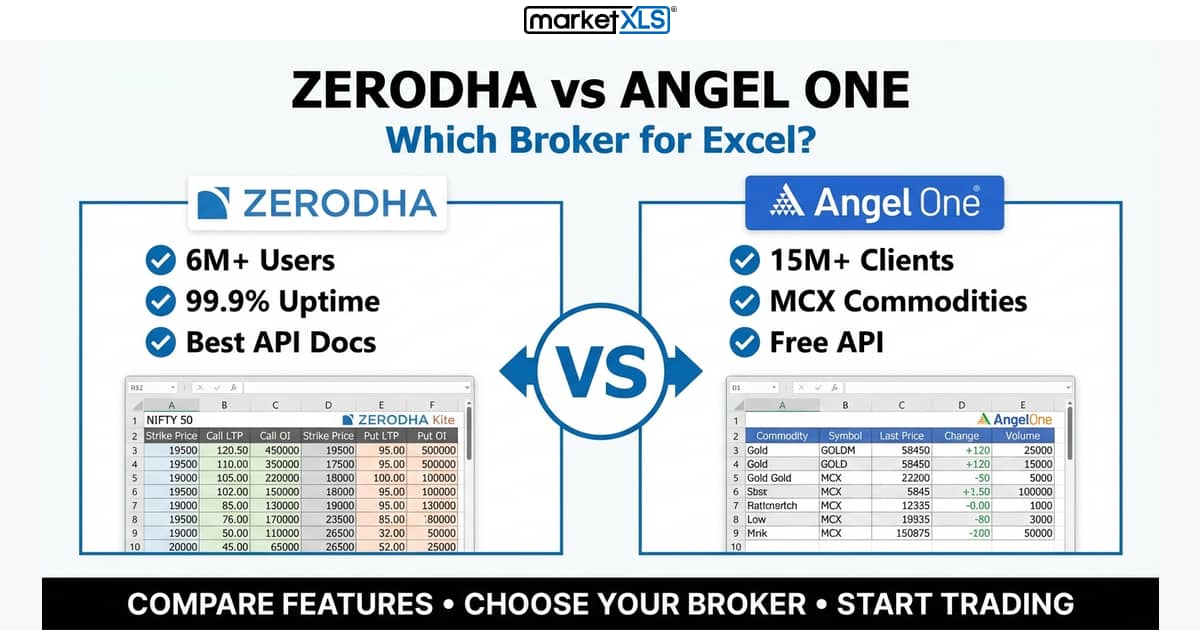

Comprehensive comparison of Zerodha Kite and Angel One SmartAPI for streaming live market data into Microsoft Excel. Detailed analysis covering market coverage, reliability, pricing, and real-world use cases to help you choose the right broker for Excel trading.

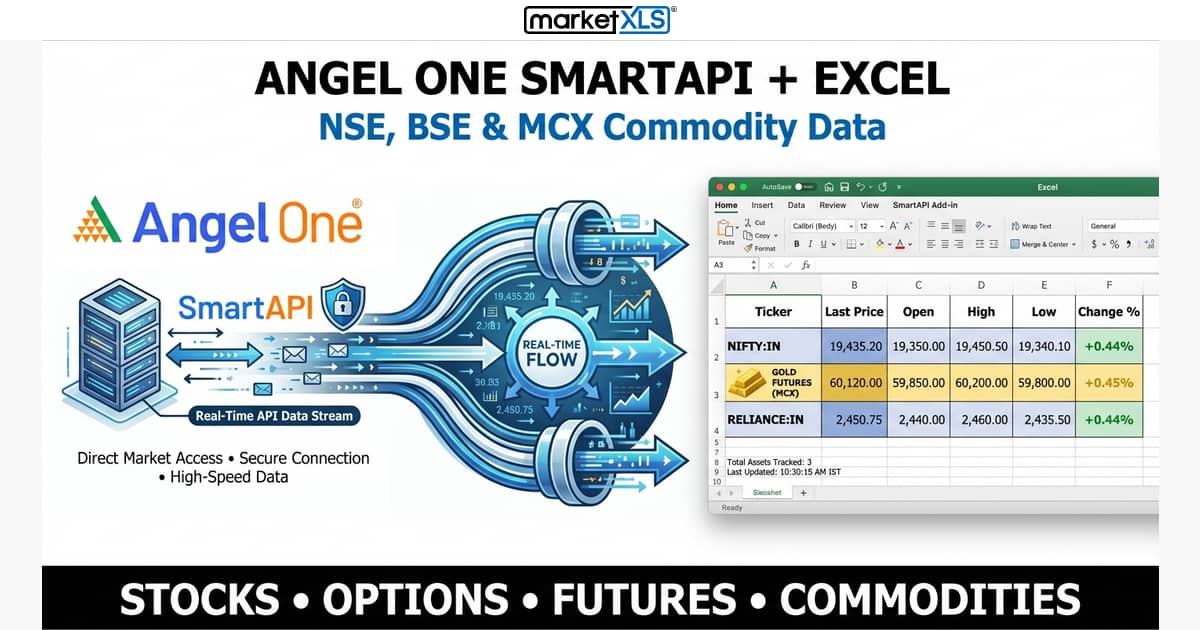

Stream real-time Indian stock market data directly into Excel with Angel One's SmartAPI and MarketXLS India. Complete guide for connecting Angel One to Excel for live NSE/BSE stocks, options, futures, and MCX commodities.

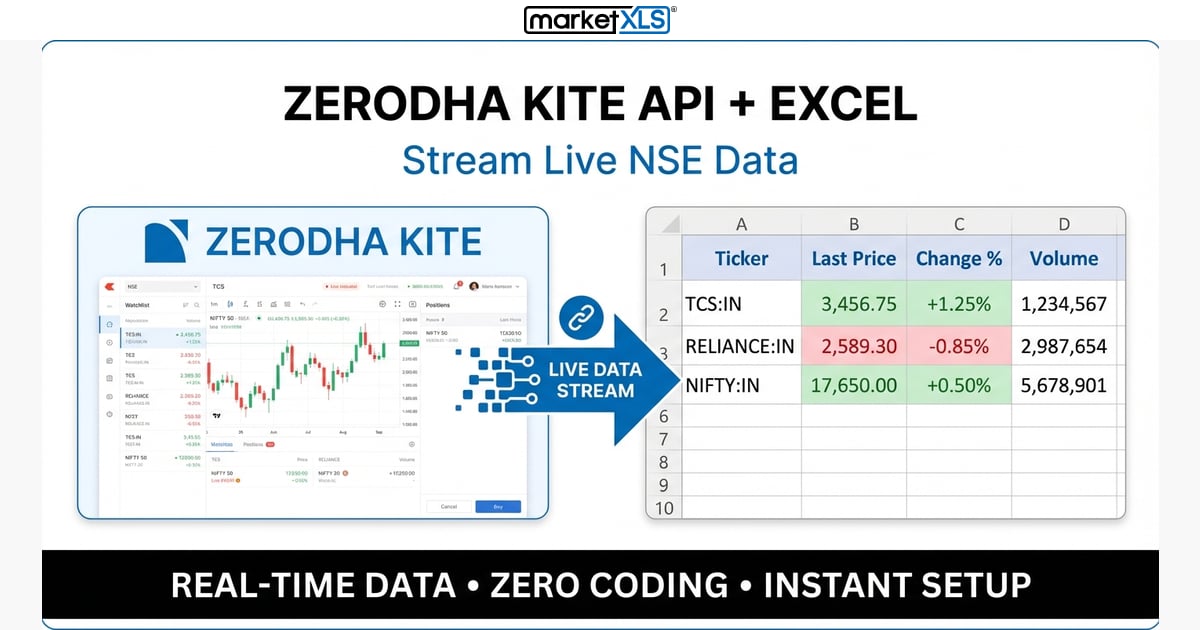

Master the power of live NSE data streaming directly into your Excel spreadsheets with MarketXLS India and Zerodha integration. Complete step-by-step guide for connecting Zerodha Kite API to Excel without coding.

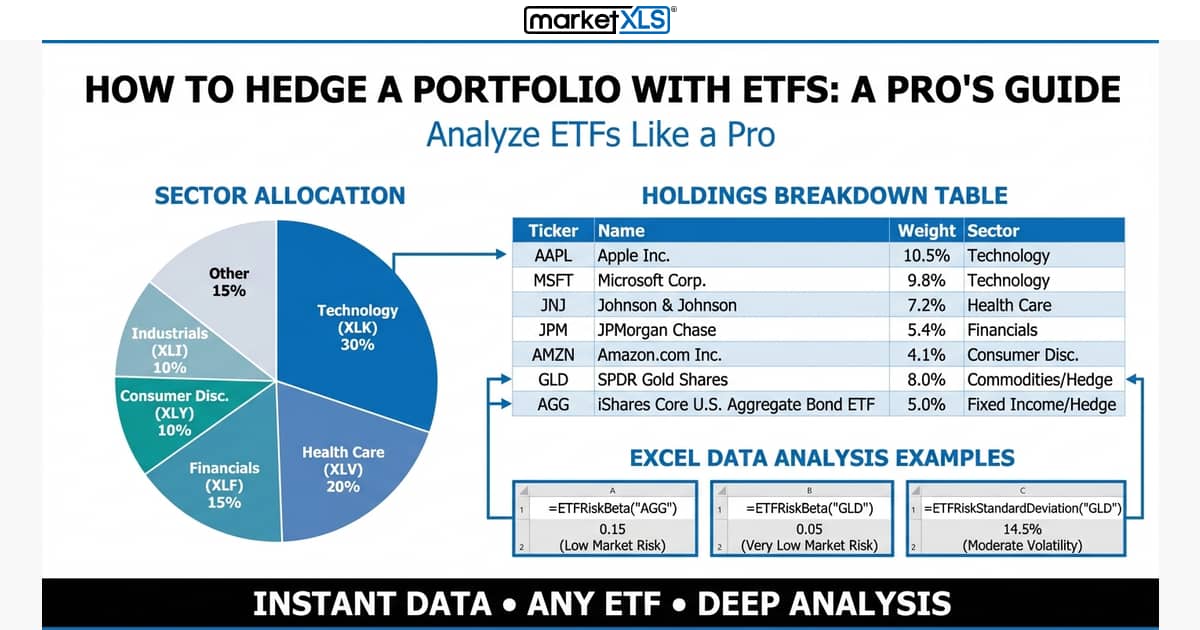

Managing risk is as critical as managing returns. Learn how to hedge a portfolio with ETFs using strategic asset allocation and tactical hedging instruments—with quantifiable, data-driven methods.

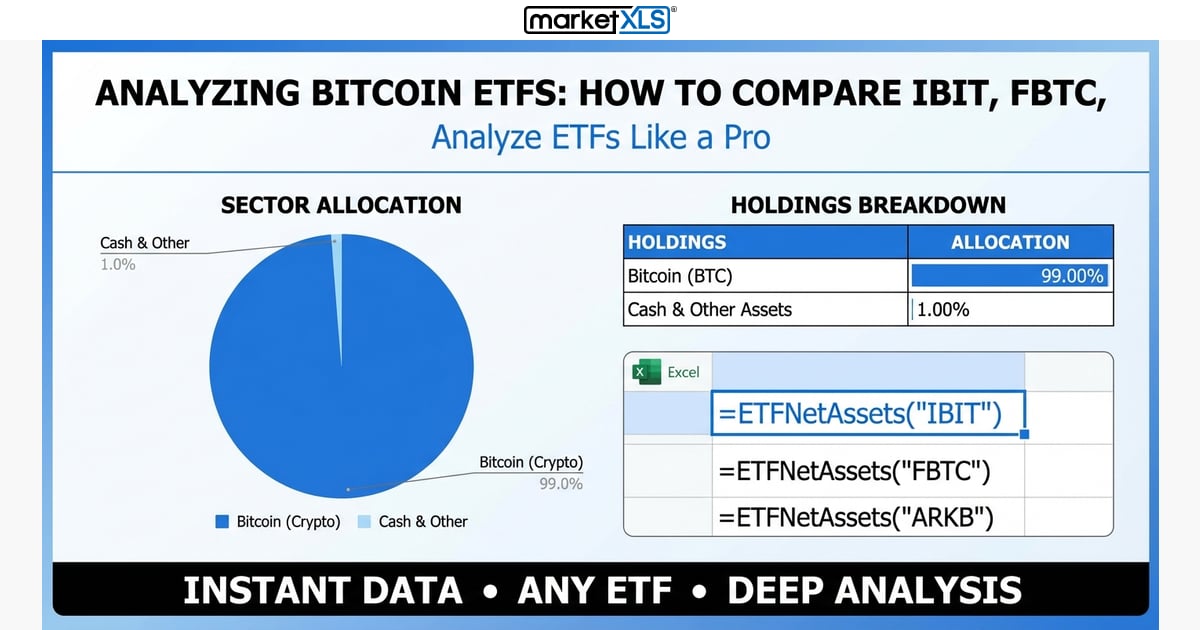

Spot Bitcoin ETFs launched in 2024, unlocking institutional access to cryptocurrency. Learn which bitcoin ETF is best by tracking fund flows, fees, and liquidity using data-driven analysis in Excel.

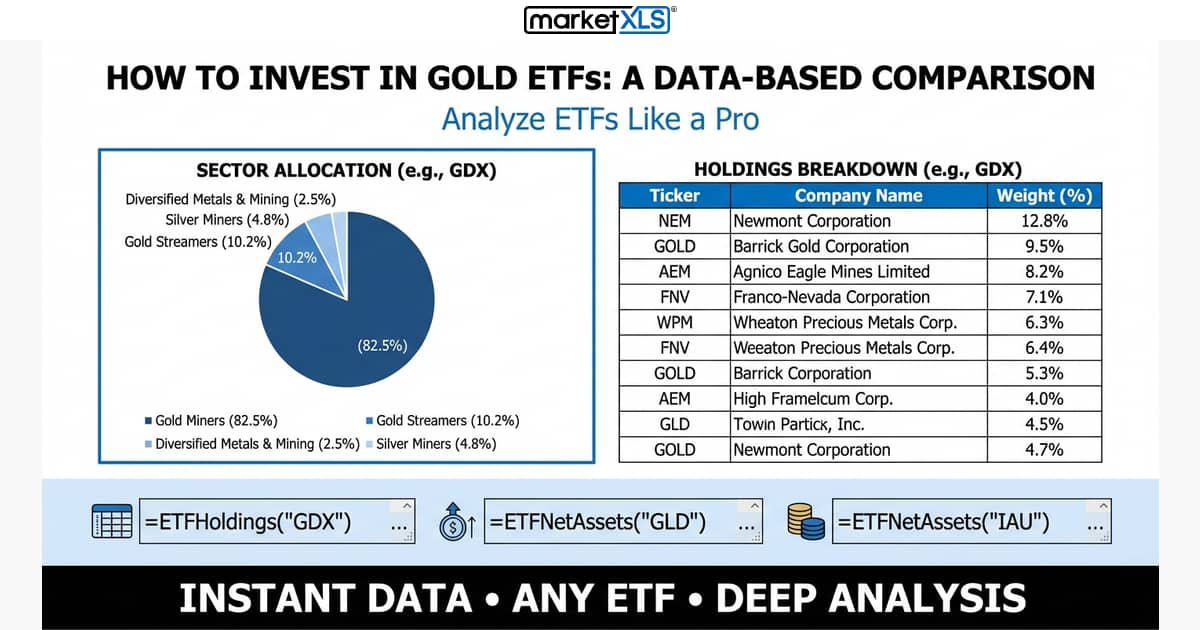

Gold ETFs provide hedging against inflation and volatility. Learn how to invest in gold ETFs, compare physically-backed vs. mining funds, and find the best gold ETF using data-driven analysis.

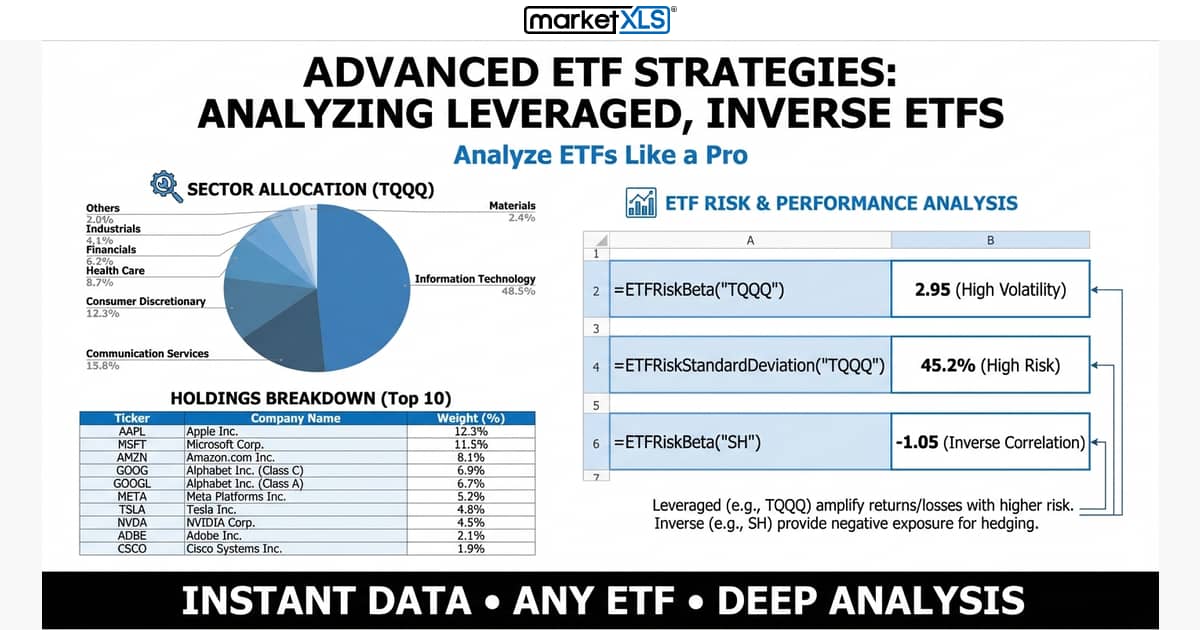

Beyond passive index funds lie specialized ETFs: leveraged, inverse, and covered call funds. Learn what these advanced strategies are, their critical risks, and how to analyze them with MarketXLS.

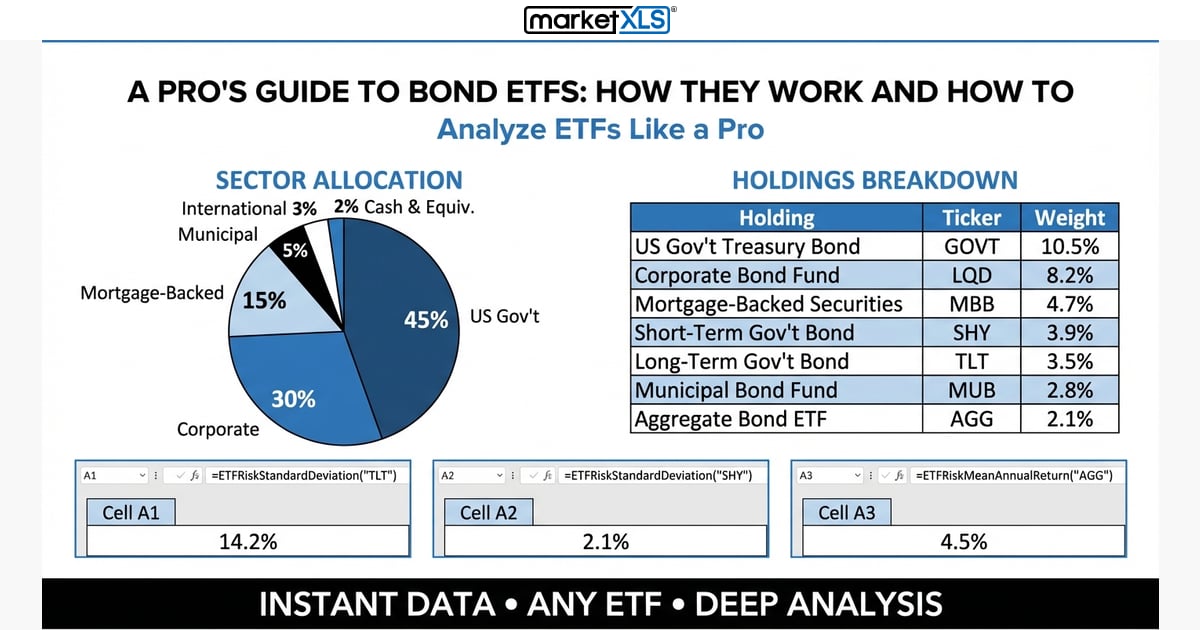

Bond ETFs are the bedrock of portfolio diversification, but they're not simple bonds. Learn what a bond ETF is, how does a bond ETF work, and how are bond ETF dividends taxed using professional analysis.

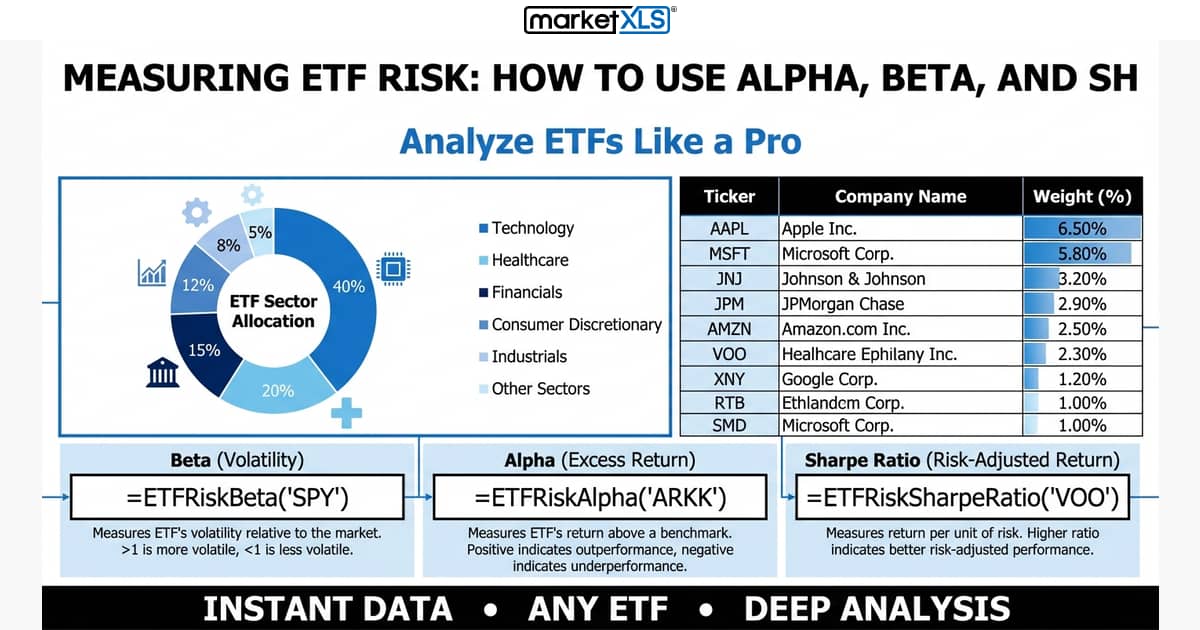

Performance is only half the story—risk is the other half. Learn how to measure ETF risk alpha, ETF risk beta, and ETF risk Sharpe ratio using quantifiable metrics in Excel with MarketXLS.

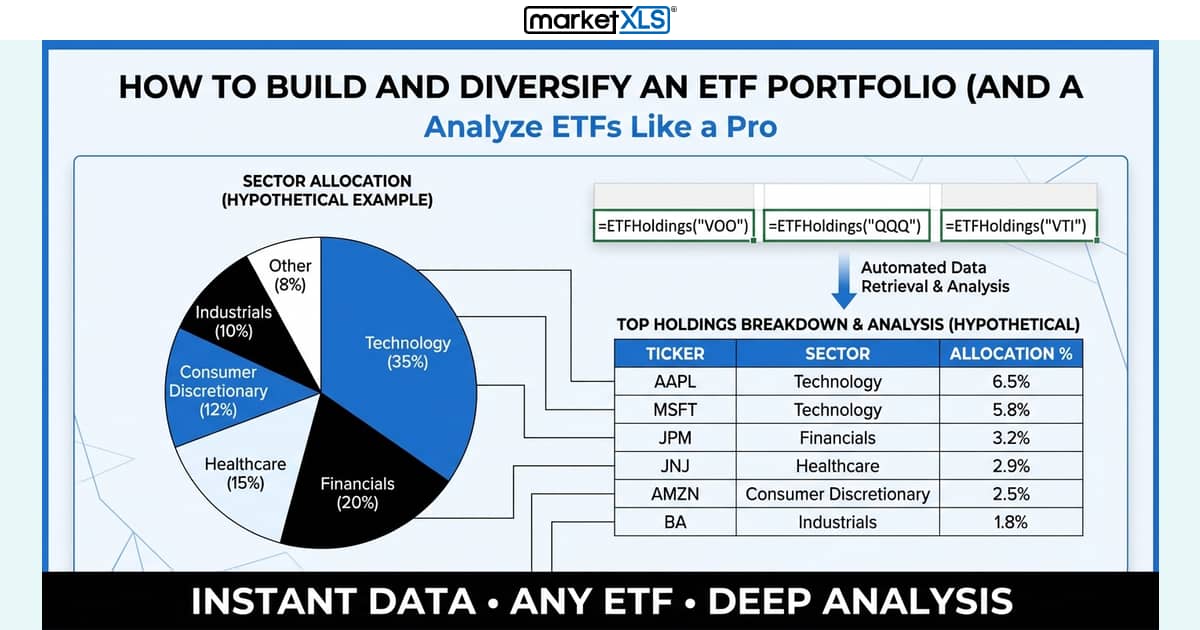

Learn how to build an ETF portfolio that's truly diversified. Discover how to identify and eliminate hidden overlap in your holdings using professional-grade analysis tools and MarketXLS functions.

Cost is one variable you can control in asset management. Learn what an ETF expense ratio is, how ETF fees work, and how to determine if a fund's costs are justified using data-driven analysis in Excel.

STOP Wasting Hours on Manual Data Entry & START Making Smarter Investment Decisions

Discover how 2,500+ serious investors are saving 15+ hours every week with real-time market data directly in Excel.

✓ No credit card required • ✓ 14-day money-back guarantee • ✓ Cancel anytime